All Categories

Featured

Nonetheless, these plans can be more complicated contrasted to various other sorts of life insurance policy, and they aren't always best for every single capitalist. Speaking to a seasoned life insurance policy agent or broker can aid you make a decision if indexed global life insurance is a great fit for you. Investopedia does not offer tax, financial investment, or monetary services and suggestions.

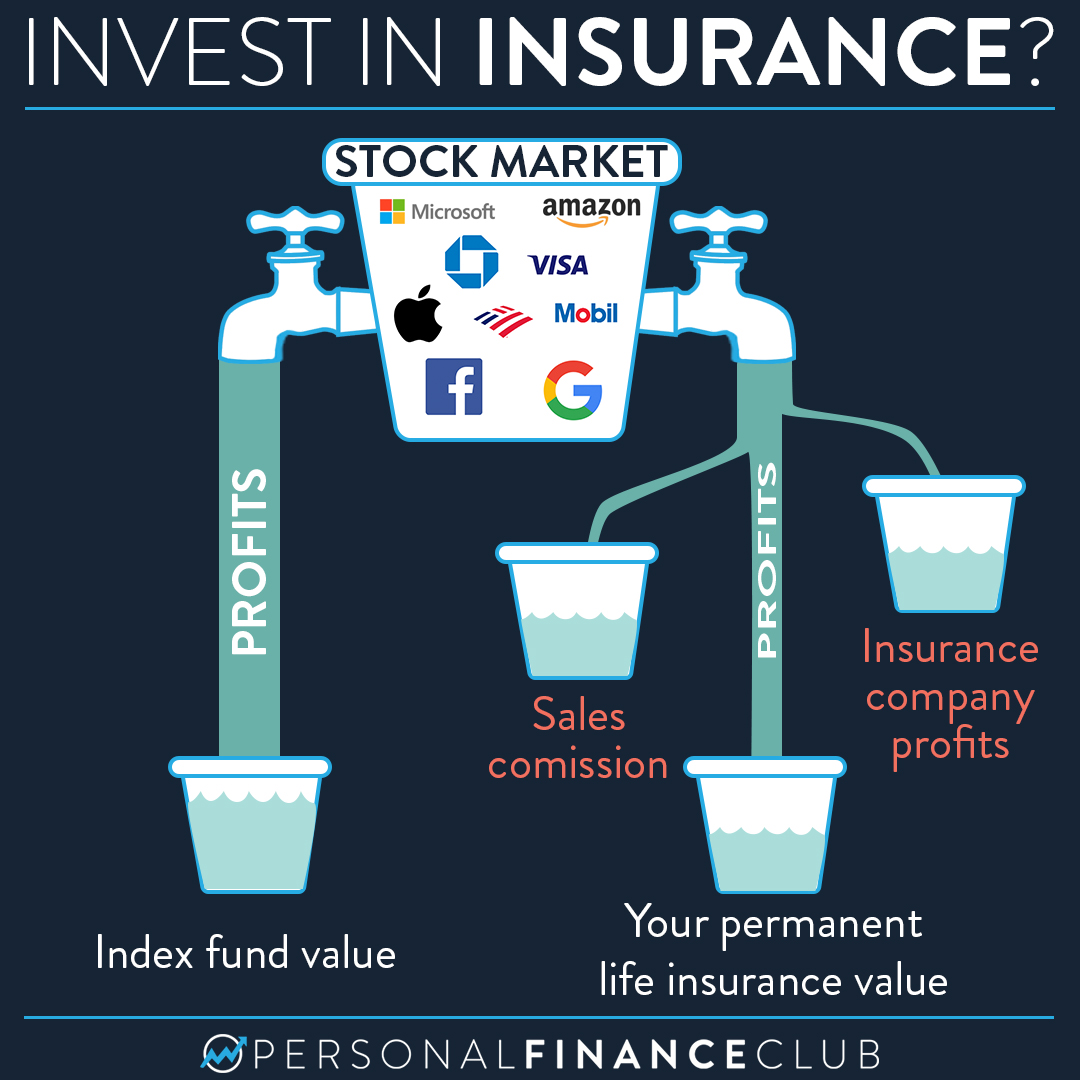

A 401(k) is a much better retirement financial investment than an LIRP for lots of people as a result of the LIRP's high costs and a low roi. You should not add life insurance policy - Indexed universal life vs employer-sponsored 401k to your retirement planning until you maximize prospective savings in a 401(k) strategy or individual retirement account. For some high-net-worth individuals, adding an irreversible life plan to their investment profile might make sense.

Applied to $50,000 in financial savings, the charges above would certainly equate to $285 per year in a 401(k) vs.

In the same veinVery same blood vessel could see can growth financial investment $7,950 a year at 15.6% interest with passion 401(k) compared to Contrasted1,500 per year at 3% interest, and you 'd spend $855 more on life insurance each insurance coverage to have whole life coverage. iuf uita iul. For the majority of people, getting permanent life insurance coverage as part of a retirement strategy is not an excellent idea.

Iul Vs 401k Retirement Planning

Below are 2 usual kinds of long-term life plans that can be utilized as an LIRP. Entire life insurance policy deals fixed premiums and money worth that expands at a set rate set by the insurer. Standard financial investment accounts commonly offer greater returns and even more adaptability than whole life insurance policy, but entire life can give a reasonably low-risk supplement to these retirement financial savings methods, as long as you're certain you can manage the costs for the lifetime of the policy or in this situation, until retirement.

Latest Posts

Index Insurance Company

Group Universal Life Insurance Cash Value

Iul Benefits